Picture this: you don’t have travel insurance. You’re on the road, exploring new destinations, soaking in different cultures, and making unforgettable memories. But while you are out and about, your phone gets stolen, or your flight gets canceled due to weather conditions. Oh no… Not only is it a huge hassle but it can also be a huge financial burden.

It’s important to have a safety net in place. It’s like having a reliable sidekick on your adventures, offering peace of mind and protection against unexpected mishaps.

In this guide, we’ll break down everything you need to know about travel insurance, from why it’s essential to how to choose the right plan for you.

Disclaimer: We may get commissions for purchases made through links in this article, at no extra cost to you. This helps keep the site running and free for all. Thank you!

What Is Travel Insurance?

Travel insurance is a type of insurance coverage designed to protect travelers from unexpected financial losses and provide assistance during trips.

Depending on your selected plan travel insurance can provide you with medical coverage if you get sick or injured on your journey, reimburse you if your new mobile gets stolen or your flight gets canceled. In worst case scenario, travel insurance can help with arrangements in the event of your death abroad (and therefore also help your family).

In short: if a covered event occurs while you’re traveling, you file a claim with documentation like receipts, medical records, or airline notifications. The insurance company then reimburses you according to your policy terms.

Is Travel Insurance Worth It?

The travel landscape has dramatically shifted in recent years. Flight cancellations are more frequent, medical costs abroad continue to go up, and unexpected events can derail even the most carefully planned trips.

Knowing you’re covered allows you to fully embrace your travels. Whether you’re hiking in Patagonia, exploring bustling markets in Marrakech, or diving in Thailand, insurance lets you focus on experiences rather than worry about potential financial disasters.

Psst: and just because you travel to “cheap” countries doesn’t mean that the medical is cheap. For example is an average cost per day of hospitalisation €99 in Venezuela. That’s the cost of almost 2 MONTHLY subscriptions to travel insurance.

To be honest, I have many times almost quit my Travel Insurance – simply because I didn’t use it in my first year of full-time travel (I know I know – the whole point is to not end in situations where you actually need insurance). But then one evening I was walking back to my hostel in Phnom Penh, Cambodia, after having dinner, and as I’m looking at google maps to navigate me, a scooter comes extremely close to me, and I stop to not get run over. Next thing I know, my phone is taken out of my hand and the scooter speeds off. And just like that my Iphone 14 was stolen. I spent the night crying and the whole next day at various police stations, trying to find the right department, who can also speak english (which is harder than you’d think) to write a police report. I have the electronics theft add-on the SafetyWing Nomad Essential Travel Insurance – so I made a claim in a few minutes and within a few weeks I was paid €711 – which is equivalent to 11 months subscription pay!

So is travel insurance worth it? In my opinion YES

The Potential Drawbacks

Travel insurance is not cheap and this extra expense can feel significant, especially for budget travelers. To that insurance policies contain specific terms that can be difficult to understand. Many travelers purchase coverage without fully understanding what’s included or excluded, and think they are covered in situations they’re actually not!

This is why researching travel insurance and choosing the right one is essential.

Please please please remember to always carefully read the terms and conditions of your travel insurance. AND know that no policy covers everything and you are always responsible for your own mistakes. High-risk activities, renting motorcycles without proper licensing and alcohol-related incidents are often not covered.

How to Choose The Right Travel Insurance

Choosing travel insurance can feel overwhelming with dozens of providers and coverage options.

Personally, I travel full-time as a digital nomad, hence why some of my requirements to Travel Insurance looks different than if I was going on a 2 week holiday.

Step 1: Consider where you’re going and what risks that presents. A beach vacation in Mexico requires different coverage than trekking in Nepal (adventure destinations often require specific activity coverage).

Step 2: Identify Your Specific Needs. This means to evaluate your age, health status, planned activities, and risk tolerance. Pre-existing medical conditions, adventure sports, or traveling with valuable equipment all influence your coverage requirements.

Step 3: Compare Providers and Policies. Ensure limits are adequate for your destination and needs. Pay attention to per-incident vs. per-trip limits, and sub-limits for specific items or situations.

My non-negotionables when it comes to Travel insurance:

- Can be extended while traveling if travel plans change (I use SafetyWings Nomad insurance which is recurring each month)

- Covers moped accidents (important if you travel in South East Asia)

- Has a twenty-four-hour emergency contact number to can call and get help no matter time-zone

- Covers electronics theft

- Covers the countries I want to visit (Make sure your insurance covers you in high-cost countries like Japan and the US if you are traveling there).

- Medical Coverage (This is non-negotiable for international travel)

- Trip Cancellation/Interruption

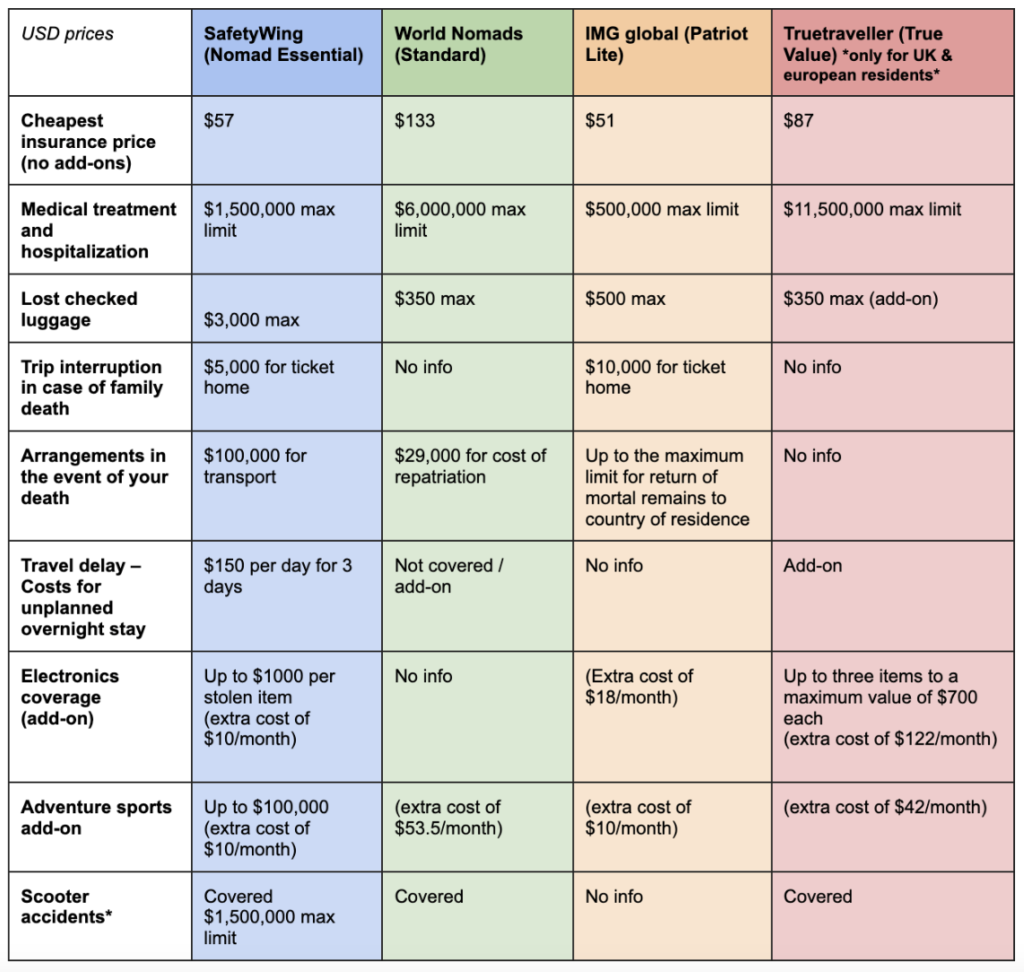

Comparison chart

Below I have created a basic comparison table over the four most reputable long-term travel insurance providers.

IMPORTANT DISCLAIMER: The information provided in this overview is for general guidance purposes only and may contain errors, omissions, or outdated details. Insurance policies, coverage options, pricing, and terms change frequently. Always verify current information directly with insurance providers and carefully read complete policy documents before making any purchasing decisions. This overview should not be considered as professional insurance advice or a recommendation for any specific provider or policy.

If you’re traveling for 1-4 weeks on holiday, I would recommend getting a quote by your local insurance providers and/or through your home insurance, as they are often a better choice for short-term travel.

*See below

Which travel insurance covers scooter rental in South East Asia?

I have travel insurance with SafetyWing for many reasons, one of them being that they are one of the only insurances who cover scooter rentals. HOWEVER it is important to know all requirements to be fully covered if you rent a scooter in South East Asia (on in general):

“In case of an accident, while riding a motorbike, moped, or scooter, you are covered for eligible medical expenses as long as you are properly licensed for the area where you are driving and you are wearing proper safety gear such as a helmet. If you are driving a scooter/motorbike larger than 50cc, you need the Adventure Sports add-on if you are on a Nomad Insurance Essential plan, if you are on the Nomad Insurance Complete plan you don’t need the add-on to be covered.”

What does “properly licensed” mean?

Well it means that you have a valid license that corresponds to the vehicle you are driving as well as have an International Driving Permit (read below). This means that you can’t drive a moped in South East Asia if your drivers license is only for a car (there are exceptions from country to country though – for example can I, as an obtainer of a danish drivers license, legally drive a 50cc moped though I don’t have formal licensing for a moped. Check with your local police department regarding your license)

What does “50cc” mean?

cc refers to the engine size in vehicles. Generally, higher cc’s means more power. Most 50cc vehicles are small scooters, mopeds or ATV’s. Here’s the trick – you’d think that it’s easy to just rent a 50cc moped while traveling in SEA and then you don’t need to go through the process of getting a new drivers license right? But it’s not that easy because 99% of bikes you can rent in South East Asia are minimum 110cc’s. Why? Unlike the flat urban environments where small 50cc bikes work well, Southeast Asia has varied terrain including steep hills, mountain roads, and longer distances between destinations. In Southeast Asia, motorcycles aren’t just for fun – they’re primary transportation for families and often cargo hauling. The larger engines provides the necessary power to handle inclines and suit other practical uses, and because that’s what is produced/imported these are also the same vehicles accessible to tourists.

What is an International Driving Permit (IDP)?

An International Driving Permit (more popularly known as an an International Driving License BUT please know that an International Driving License is not a legal document and cannot be used to drive in foreign countries or instead of an IDP) is a document containing official translation of your national driving licence. It is issued through worldwide network of AIT/FIA organisations, duly authorized by their governments to issue IDPs. Most countries require visitors to have an IDP. You can get either a digital or printed IDP, where digital ones are both cheaper and quicker to optain – BUT be aware that not all countries accept digital IDP’s!! Read more about it here

Popular countries where digital IDP’s are accepted: Laos, Australia, United States of America, Argentina

Popular countries where digital IDP’s are NOT accepted: Thailand, Vietnam, Indonesia, Italy

When To Choose add-ons?

Travel insurance add-ons can significantly enhance your coverage, but they also increase costs. Understanding when these extras are worth the investment versus when they’re unnecessary expenses is crucial for smart travel planning.

Common add-ons include Cancel for Any Reason (CFAR), adventure sports coverage, rental car protection, electronics coverage, and increased coverage limits.

When to Choose Adventure Coverage:

If you (like me) choose the SafetyWing Nomad Essential Travel Insurance – opting for the “Adventure Sports” add-on is a good idea if you plan to do any of the following during your trip:

- Renting a scooter (over 50cc)

- Paragliding / Skydiving

- Whitewater rafting

- Cave diving

- Skiing

- Scuba diving

- Remote Location Adventures

See all covered activities here

When to Choose Electronics Add-Ons:

If you plan to travel with multiple expensive devices and/or to Theft-Prone Destinations. Here it’s super important to make sure the providers policy includes coverage of your specific devices.

SafetyWing’s “Electronics Theft” add-on include Laptops, cameras, lenses, smartphones, e-readers, music players, tablets, earphones, iPads, airpods and drones (especially drones are rarely included in Electronics add-ons).

Important to know about submitting a claim with your travel insurance

Most travel insurances have very specific requirements you need to abide by in order to successfully submit a claim. These often include:

- Provide receipts for the costs associated with your claim

- You have a police report submitted within 24 hours after a theft or accident

- You obtain necessary documents for example a medical report in case of hospitalisation

If you have any questions regarding what you need to provide, how a claim works or any other concerns the SafetyWing team is available 24/7 and answers within minutes via chat. You can also email them or call International assistance on +1 844 531 0151

Read more about terms for a SafetyWing subscription here