Picture this: you’re on the road, exploring new destinations, soaking in different cultures, and making unforgettable memories. But while you are out and about, your phone gets stolen, or your flight gets canceled due to weather conditions. Not only is it a huge hassle but it can also be a huge financial burden. That’s where global travel insurance comes in.

It’s important to have a safety net in place. It’s like having a reliable sidekick on your adventures, offering peace of mind and protection against unexpected mishaps.

In this guide, we’ll break down everything you need to know about travel insurance, from why it’s essential to how to choose the right plan for your nomadic lifestyle.

What is SafetyWing?

The global safety that SafetyWing is building, is for anyone that wants to be location independent and insured.

They offer 3 kinds of insurances:

1. Nomad Insurance

Global Travel Medical Insurance for Nomads

2. Nomad Health

Global Health Insurance for remote workers and nomads

3. Remote Health

Global Health Insurance for remote companies

In this post you will get insight to their Nomad insurance. Read more about all of their offers HERE

What does the Nomad Insurance include?

With SafetyWing you can freely travel insured to 180+ countries including:

- Coverage for travel delay

- Lost checked luggage*

- Emergency response

- Natural disasters

- Personal liability

- Medical assistance

- Prescription drugs in relation to a covered illness or injury.

And more!

SafetyWing also has a 24/7 customer service team is always there to help you if you’re unsure about what to do, what documentation you need or anything else.

*You must have filed an incident report with the airline/cruise line and completed their instructions and forms to attempt to retrieve your luggage + You provide proof of the existence of your items before they went missing.

Please note: Nomad Insurance is not a replacement for health insurance as it is only designed to cover accidents and emergencies that may happen while you are traveling.

When can you buy Nomad Insurance?

You can start your coverage whenever you want – both before or after your travels has begun. It automatically extends every 28 days from you sign up until you pick an end-date. That way you can be as flexible as you want.

One active insurance period lasts a minimum of 5 days, up to a maximum of 364 days. You can keep buying new insurance plans an unlimited amount of times, until you turn 70 years old.

The insurance works while you are outside your home country, and for medical coverage during short visits home.

What does the Nomad Insurance NOT cover?

- Chronic conditions

- Pre-existing illness or injury (You received a prior diagnosis or treatment for the illness or injury within 2 years before the start date).

- Travel in the United States of America (unless you purchase the add-on of coverage in the USA)

SafetyWing complies with US, UK, EU and UN sanctions and you can therefore NOT use the insurance in Belarus, Cuba, Iran, North Korea, Russia, Syria or Ukraine.

Make sure to read SafetyWings Policies thoroughly HERE

Are sports activities covered?

Yes! Or rather “some” sports for example:

- Bungee jumping

- Camel riding

- Canoeing

- Horse riding

- Safari tours

- Snorkelling

- Surfing

- Zip line

Important conditions:

- Professional: If you are a professional athlete or an instructor, you are not covered while practicing your sport.

- Organized: The sport or activity cannot involve intention to compete.

- Rewarded: There can be no wage reward or profit connected to you doing the activity.

- Expeditions: You are not covered while exploring remote or inaccessible areas for example within Antarctica, the Arctic Circle or Greenland.

- Safety: You must ensure the sport or activity is adequately supervised and that appropriate safety equipment (such as helmet, life jackets etc.) are worn.

What Add ons can you purchase?

Adventure Sports

Including dangerous sports such as:

- Paragliding

- Skydiving

- Whitewater rafting

- Cave diving

NOTE: conditions regarding sports activities covered by the basic Nomad Insurance apply to Adventure Sports as well.

Theft coverage for electronics

Electronics covered are: Laptops, cameras, lenses, smartphones, e-readers, music players, tablets, earphones, earplugs, iPads, airpods and drones.

Important conditions

- You took reasonable care for the safety of your electronics.

- The theft is reported to the police within 24 hours.

- You provide proof of the existence of the electronics before they were stolen

SafetyWing covers

- Up to $3,000 per active insurance period

- Up to $1,000 per electronic.

Coverage in the USA

If you have this add-on you’ll have the same coverage on trips to the US, as you do outside the US.

You will still have to pay:

- $100 co-pay for each visit to an emergency room in the US.

- $50 co-pay for each visit to an urgent care center

in the US.

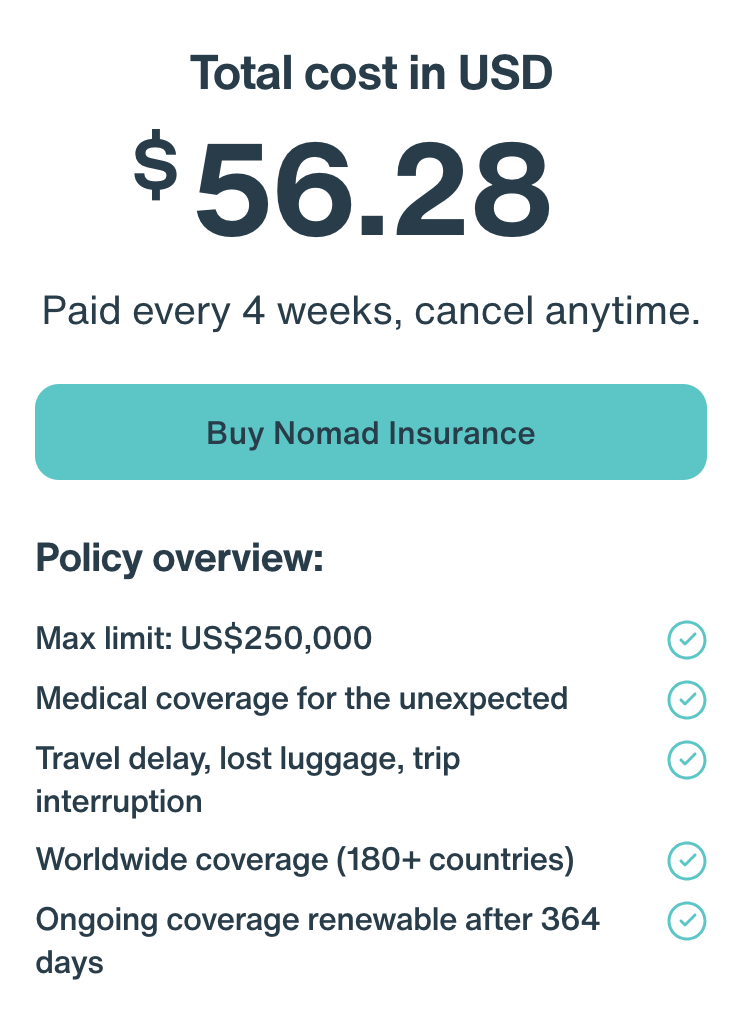

What does Nomad Insurance cost?

If you are between age 10-39: $56.28 / a month.

- US coverage: extra $48.16 / a month

- Adventure sports: extra $10 / a month

- Electronics theft: extra $10 / a month

If you are between age 40-49: $92.40 / a month.

- US coverage: extra $79.52 / a month

- Adventure sports: extra $10 / a month

- Electronics theft: extra $10 / a month

If you are between age 50-59: $145.04 / a month.

- US coverage: extra $137.76 / a month

- Adventure sports: extra $10 / a month

- Electronics theft: extra $10 / a month

- US coverage: extra $189.28 / a month

- Adventure sports: extra $10 / a month

- Electronics theft: extra $10 / a month